What Are You Missing in Forex Trading?

Apr 4, 2022

By Frank Kaberna

To the average stock trader, forex markets can look boring. EUR/USD, JPY/USD, and GBP/USD with their fraction of a penny moves and single digit implied volatilities have long looked unattractive.

Source: dxFeed

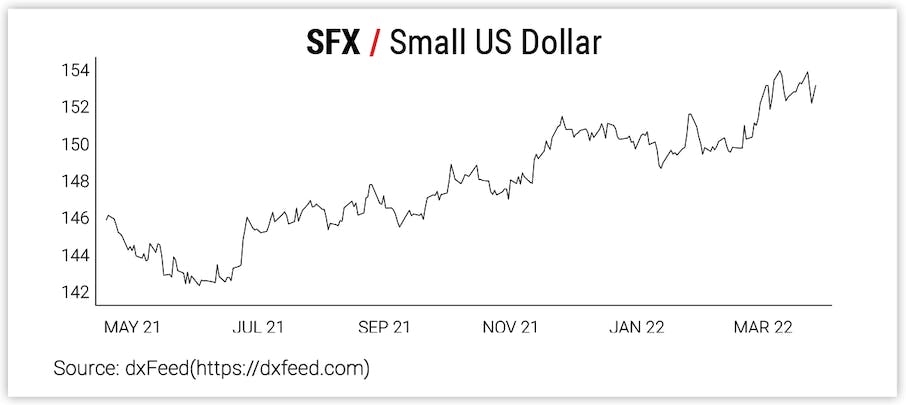

$2,000 gold and $100 crude oil make the headlines, sure, but US dollars have seen considerable movement amid the increased action in US rates. Why hasn’t USD seen similar upside to the US 2 Year yield? Well, because US currencies are priced against others whose central banks are also raising interest rates, and that’s where the opportunity can be.

How Forex Markets are Priced

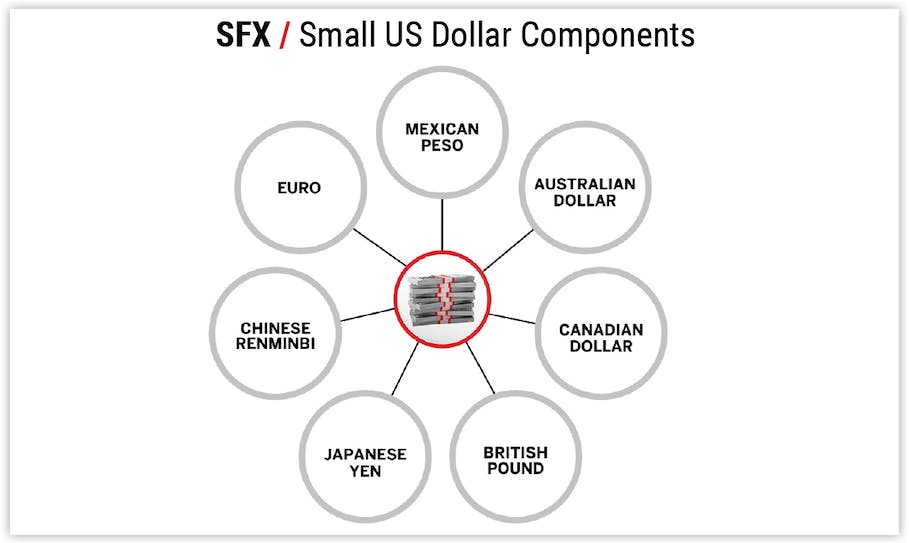

Almost any product you might access in the currency space, from forex markets like EUR/USD to ETFs like FXE, refer to a currency priced against at least one other currency. For example, you are trading the euro against the US dollar then you put a position on in FXE. Most USD products like Small US Dollar futures consist of the dollar versus a basket of currencies.

This creates price action unique to the currency space in that an item that’s bullish for the US alone might increase USD-based products and lower the value of products priced against USD; but bullish news for a multitude of economies can coincide with large swings with little displacement of any currency markets.

US Dollar Futures and Options

This concept results in many traders simply taking the other side of large swings in a product like US dollar futures with the idea of mean reversion working in the background. US raising rates? Dollar higher! Bank of England raising rates? Dollar lower! You can see this back-and-forth attitude reflected in this year’s SFX price action.

Source: dxFeed

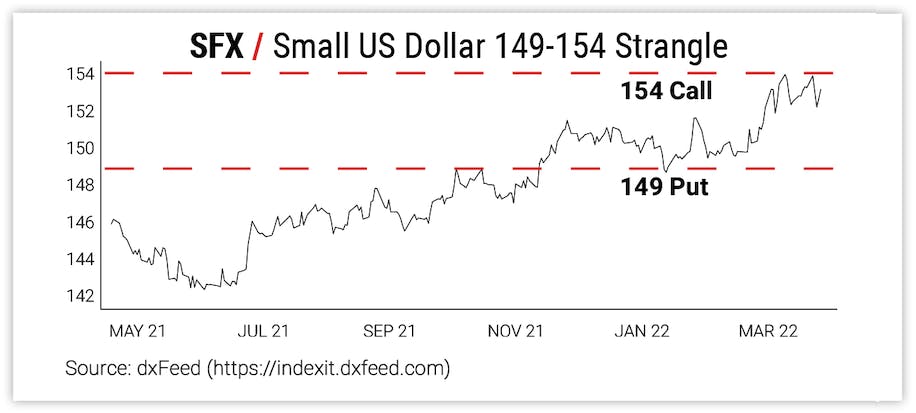

With US dollar options, you don’t even need to wait for the big moves to occur, as the current 149-154 strangle in May SFX options can give you $75 in credit received and theoretical breakevens outside the entire range for 2022. Find out what you could be missing in forex.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.