Value Investing for Interest Rates

Jul 19, 2021

By Frank Kaberna

What goes for “valuable” in a given year can seem truly random. So far in 2021, GameStop (GME) has gone from trading in single and double digits for more than two decades to a high of $483*; Dogecoin went from a range of $0.001-0.017 since inception to $0.57 highs†; and even Pokémon cards‡ are worth hundreds of thousands of dollars more than they used to be.

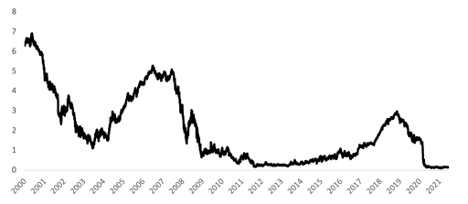

It’s not rare for a market to lie seemingly dormant for years at a time before ascending to new heights hundreds of percentage points higher. In fact, Treasury yields have been resurrected several times in the last handful of years, and they could be in the midst of another such ascent.

2YR US Treasury Yield

US Treasury (treasury.gov)

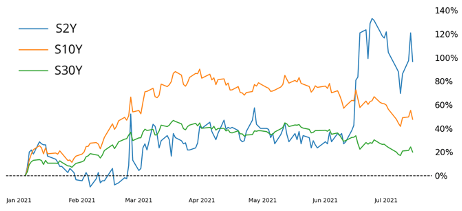

Percents on Percents

In percentage terms, 2YR yields have performed the best in 2021, but this upside has come on the heels of historically low levels in short-term rates. If you’re accustomed to buying the outperformer, then it’s Small 2YR futures; if you’re used to going for the laggard, then it’s Small 30YR futures. But even more historical context might be helpful.

S2Y vs S10Y vs S30Y \ Small Yield Index Performance

Source: dxFeed Index Services (https://indexit.dxfeed.com)

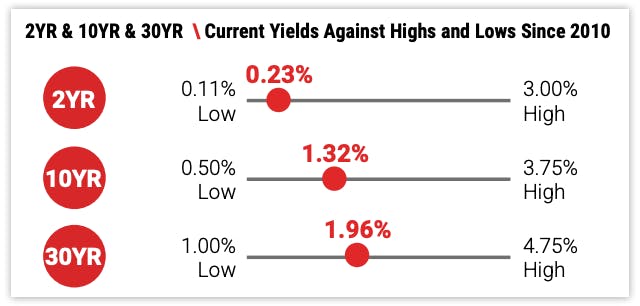

The Most Valuable Yield

Though 2YR yields have seen the most upside across the curve in 2021, they’re much closer to historical lows than their 10YR and 30YR counterparts. Going back to 2010, none of these three yields are even halfway back to their prior prominence.

2YR & 10YR & 30YR \ Current Yields Against Highs and Lows Since 2010

US Treasury (treasury.gov)

Hunting for the next “valuable” thing can be extremely difficult, especially when tastes change as rapidly as they do now. A potential investment that has historical backing, however, can make you feel better than buying shares, coins, or cards that people have decided simply must go higher.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*From 2000-2020, GME low of $2.57 and high of $63.77. GME new high on 1/28/21.

†Dogecoin invented in 2013, and it hit high of $0.017 on 12/31/17.

‡Price history for Pokémon cards: https://pokemarketcap.com/