The End of an Era for the Euro

Jul 5, 2022

By Frank Kaberna

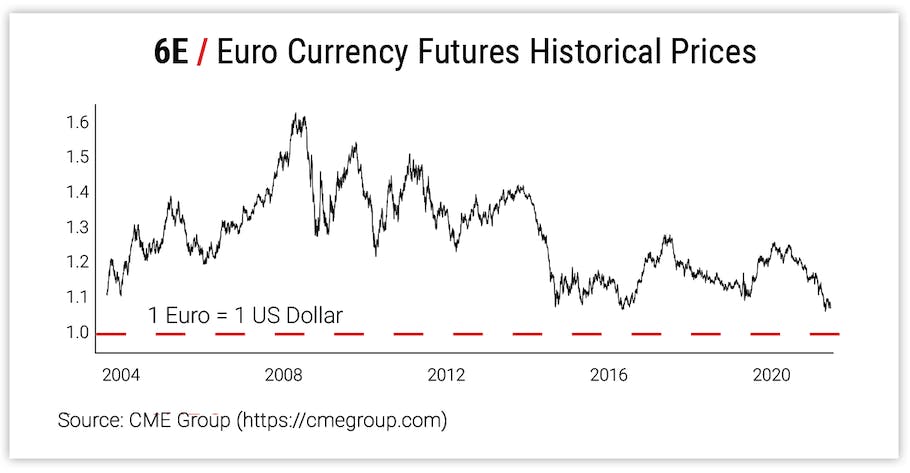

If you started trading in the last two decades, you’ve only known a world in which the euro is worth more than the US dollar. You’d have to go all the way back to 2002 to find data points representing the EUR/USD conversion rate that start with a zero to the left of the decimal point.

Source: CME Group

Today, the euro is trading as close to parity with the dollar as it has for the last several years - under $1.05.* Will the euro finally crash below $1 for the first time in 20 years? Or, is yet another bounce coming as it did in the late 2010s?

Euro-US Dollar Conversion Rate Historical Prices

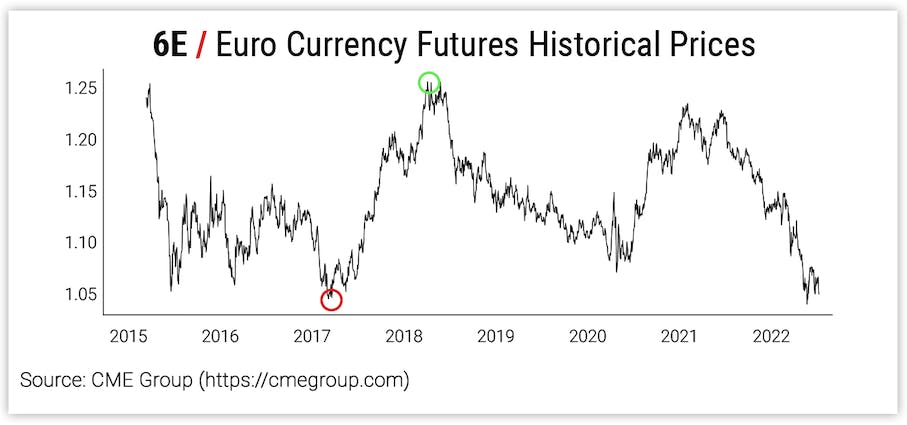

Though it may look like the sky is falling in the Eurozone, their currency has been here before. Actually, the euro broke $1.05 back in 2017 only to close the year above $1.20.

Source: CME Group

This historical data, of course, does not guarantee a path higher for EUR/USD, but it at least sets a precedent for the eurozone currency to bounce back just when sub-$1 prices may seem inevitable.

Probability of a $1 EUR/USD Conversion Rate

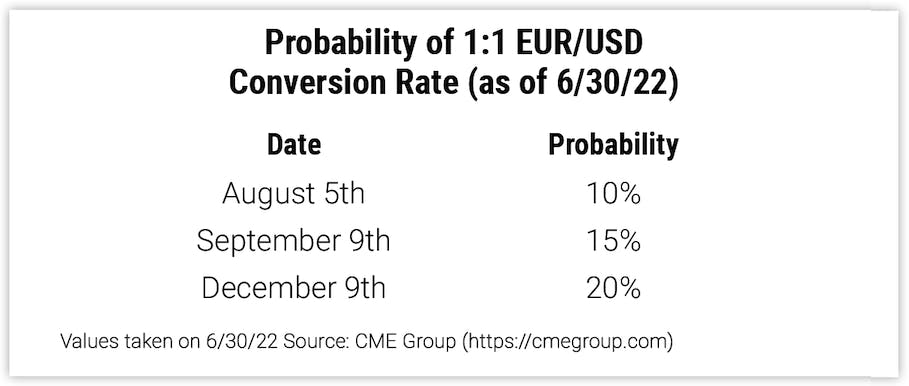

All of that said, some are placing bets on euros falling below parity against dollars as soon as August. Prices on the 1.00 Euro FX Futures (6E) options project a 10% chance of the euro reaching $1 by August 5, 2022, and the same strike options in longer-term expirations only see rising probabilities of such an event.

Values taken on 6/30/22 Source: CME Group

If you think even a 10-20% chance of this event that hasn’t occurred since 2002 is too high, then you can sell the 1.00 puts in 6E; if you think euro-dollar parity is coming by the end of 2022, then you can buy them. Alternatively, a trip down to 1.00 in the relatively large 6E futures would roughly coincide with a journey north of 168 in Small US Dollar Futures (SFX). Selling or buying SFX calls in that range could yield a smaller version of this strategy.

The financial media loves to call for the end of an era whenever it’s close to being relevant, but, more often than not, the same old song continues. Futures and options let you call BS or FACTS when the news story comes up.

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

*All values in this article taken 6/30/22 Source: CME Group