While We Wait for Stocks to Move

Dec 14, 2020

By Frank Kaberna

The WFH culture spawned by the global pandemic has intersected with some of the greatest technological and societal advancements ever (such as the iPhone 12 Pro Max and Real Housewives of Salt Lake City) to foster the indisputable winner of 2020: screen time.

According to the Nielsen Total Audience Report, adults in the U.S. are spending about 741 minutes (or 12.35 hours) in front of screens per day.* For context, adults are awake for an average of 939 minutes (or 15.65 hours) per day.**

And Neilsen accounts for most of this growth in the sector of screen usage defined by app/web on a smartphone, of which trading platform usage is a subsector. So what has the stock market given traders with more screen time? Other than high prices, not much seemingly...

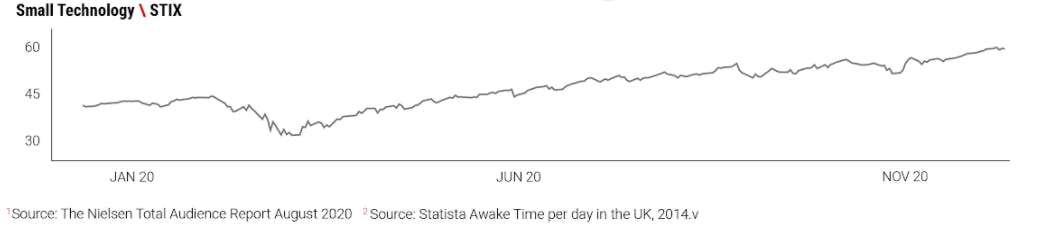

The CBOE’s Volatility Index (VIX), a gauge of both fear for passive investors and opportunity for active traders, hit lows last week not seen since before pandemic news broke in February. Small Technology (STIX) futures that track 60 of the most active tech stocks from info, media, retail, and biotech have receded to the smallest ranges of their short existence.

That said, intraday volatility has not fallen off. The high-to-low range in STIX futures is sitting at 240% of the close-to-close. STIX’s average daily move is +/-0.75; if the market closed +0.75, then its range was likely -0.15 to +1.65 intraday. Thus there is about 0.90 worth of scalping opportunity on either side of where STIX closes on a daily basis.

Long stocks? You can use short STIX trades as a short-term hedge and source of trade activity that has the potential to generate income as you wait for the stock market to make its next move. Those with short stock portfolios can accomplish the same with long STIX plays.

Just because Taylor Swift puts out more albums than the stock market does multipercent down days doesn’t mean you should trade screen time on stock apps for TikTok or Spotify. Not as long as the intraday opportunity exists.

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.