The Best Dips to Buy

Aug 23, 2021

By Frank Kaberna

Almost every market since the invention of markets has dipped in price. Corn in the 1930s, original vinyl pressings of Fleetwood Mac’s Rumours in the early aughts, and stocks at the start of the pandemic all have this in common, and they’ve all managed to fight their way back.

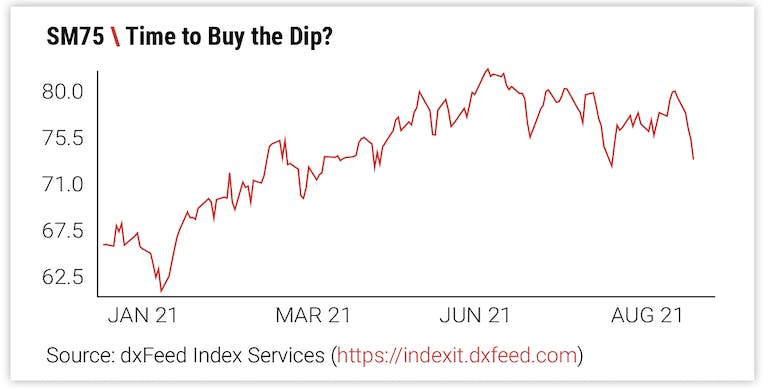

While some are interested in asking why such troughs occur, opportunistic investors focus efforts on when the market will bounce back. Given recent shakiness in equities and crude oil, a deep dive into historical dips could aid you in trading future markets.

Is It a Dip Worth Buying?

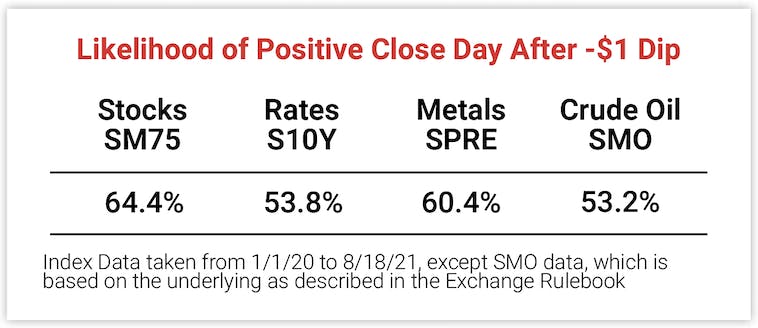

There’s a difference between cheapness and value, and traders must distinguish between the two when deciding whether or not to buy a dip. Historically, all four asset classes in this study - equities, interest rates, precious metals, and energy - have tended to move higher the day following a dip, and stocks have shown the strongest version of this trend.

How High Can It Bounce?

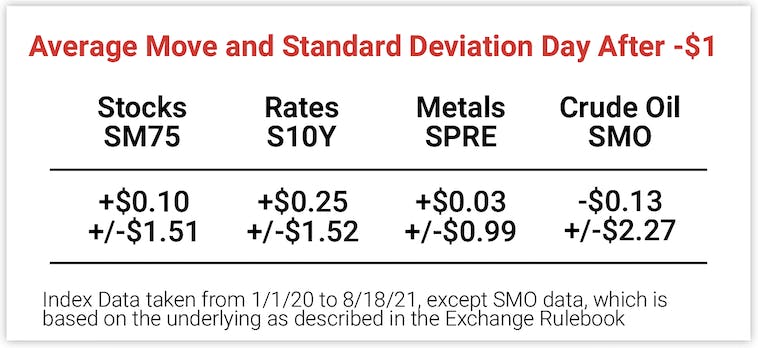

It’s not enough to know that the market closes higher the day following a dip more often than not. Crude oil, for example, has shown a negative average move after a dip even though it has tended to move up.

That said, the large standard deviation on SMO’s average move means there’s large potential, and risk, in buying crude on the dip. Stocks and rates both offer solid average bounces without abnormally large risks around them.

Buying the dip isn’t as simple as armchair traders make it seem on social media, but it can be easier than picking the next cultural trend with solid data and the right product.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.