How to Trade Volatility with Futures Options

May 9, 2022

By Frank Kaberna

Volatility is at the core of almost all options strategies. Whether you’re looking to get long, short, or neutral, the price of options, and thus the market’s implied volatility (IV), can factor into whether you are committing that directional bias as a net buyer or seller of options.

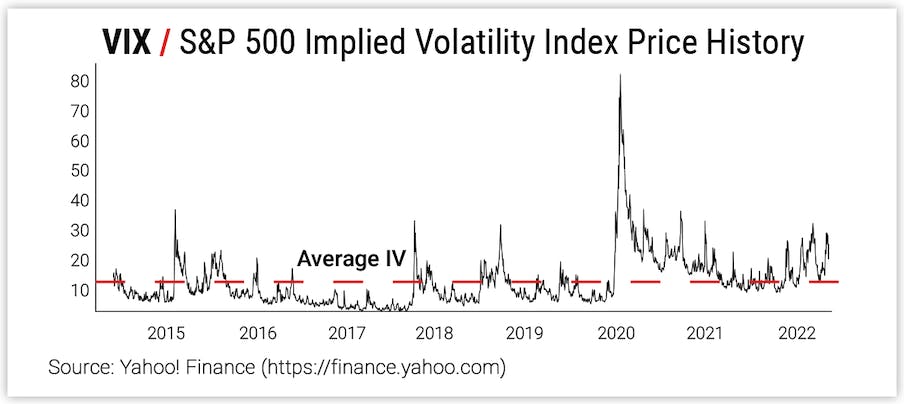

Stock options traders can easily monitor the overall price of the market using the S&P 500 Implied Volatility Index (VIX), which measures IV across multiple options strikes and expirations in SPX. The historical average in this market is about 18%* going back to 2015, and so traders may look to short strangles, straddles, and iron condors when VIX is above that average; that is, there is potential opportunity for mean reversion in option prices by selling options when they’re more expensive than average. And this opportunity can translate from the S&P 500 Index options to SPY options and onto Micro S&P 500 futures options; the major difference is size and capital required.

Are the same options trading opportunities seen in stocks available in other asset classes like forex and metals? Can you transfer your strangle and iron condor strategies from stock options to futures options?

Forex Volatility and Gold Volatility

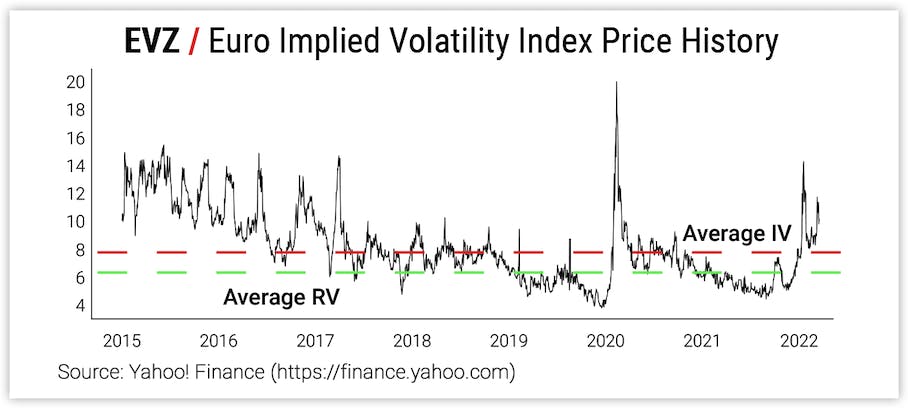

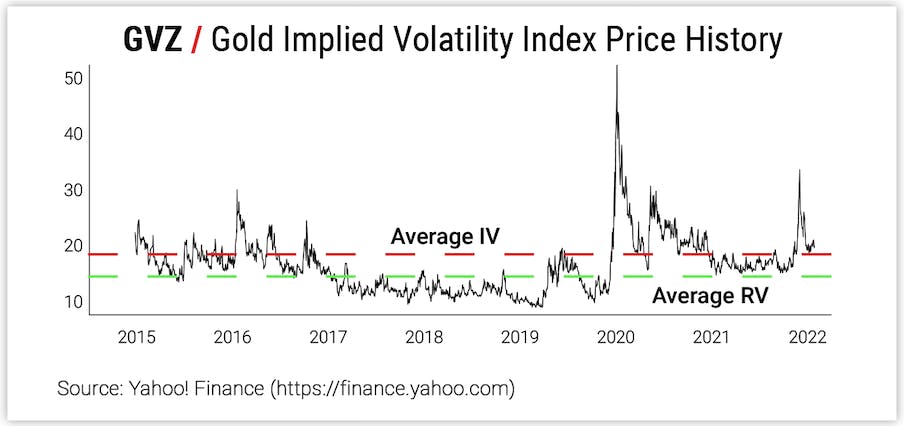

Implied volatility in a forex market like the euro currency or a metals market like gold operates in much the same way as stock IV - there’s an average IV, options prices spike above that level, and prices revert lower.

The average implied volatility in the euro options market has been 8% going back to 2015, and the realized volatility (RV) - actual movement in the underlying market - was 6.5% in the same time frame.† This means that there tends to be overstatement in options prices on forex markets, which could have created profits for options sellers in the past.

Similarly, gold options prices have overstated actual movement in the past to the tune of 15.5% average gold IV compared to 12% average gold RV.‡

How to Trade Options on Forex and Gold

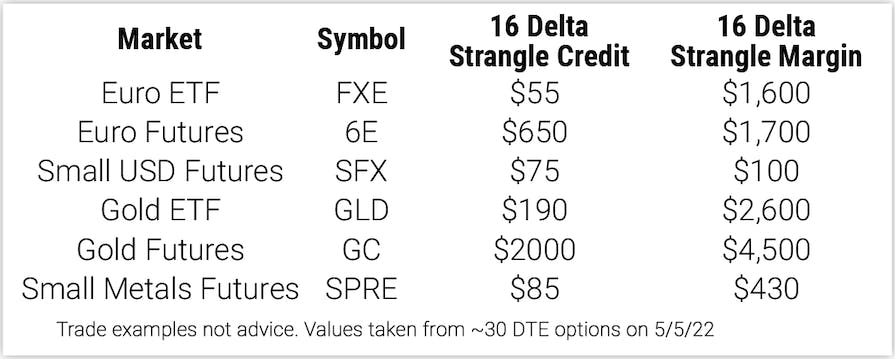

You can trade forex and gold options using either ETF or futures options. ETF options will likely look and feel more comfortable to the stock options trader, but futures options are often more direct in the way they track the underlying market and are less costly per unit of exposure.

Futures options can afford much greater potential returns on capital compared to ETFs, but ETF options might look and feel like what you’re used to. Each product has its own pros and cons, but the opportunity is still relatively the same no matter which vehicle you choose.

If you’re used to $5-wide iron condors in stock options, you can throw on an iron condor in futures options risking $500 that usually ends up performing similarly. Same goes for your 16 delta strangles, at-the-money straddles, and beyond. Futures options can present the same underlying markets and strategies as stock options, they can just differ in size and capital required.

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

*S&P 500 Implied Volatility Index Data Source: Yahoo! Finance

†Euro Currency and Implied Volatility Index Data Source: Yahoo! Finance

‡Gold and Implied Volatility Index Data Source: Yahoo! Finance