How to Trade Cryptocurrency Futures

Apr 20, 2022

By Sage Anderson

Cryptocurrencies are volatile to say the least. Bitcoin has doubled in price and been cut in half in the last year alone, and some smaller market capitalization coins have moved to even greater degrees. This type of action can both pose risk to investors and opportunity to traders.

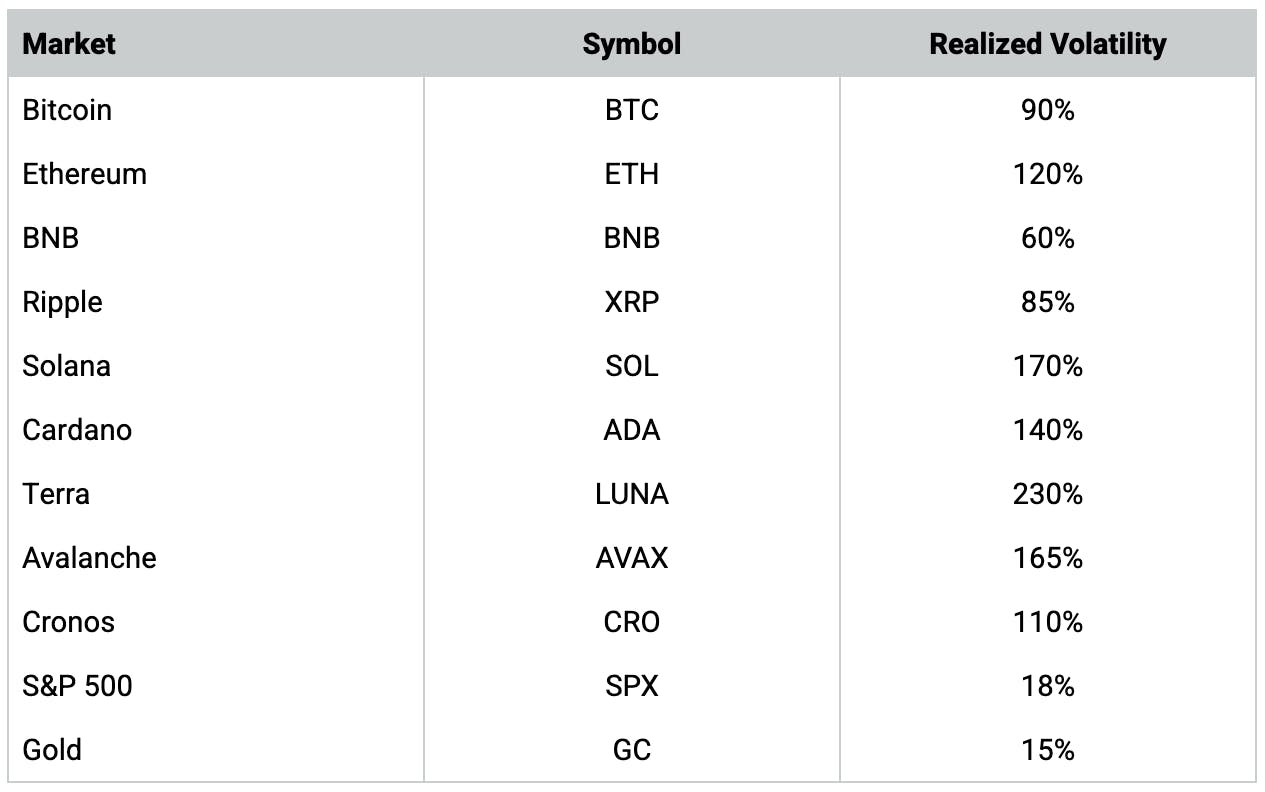

These are the realized volatilities for some of the biggest cryptocurrency coins as well as popular non-crypto markets for reference:

Realized Volatilities of the Biggest Cryptocurrencies

Considering the level of risk buy-and-holders in the crypto space stand to take relative to those in equities, passive investors might sleep a little easier if they had some methods to reduce risk.

Are there tactics crypto investors and traders can use to protect themselves if this volatility continues? Absolutely, and those tactics can be especially useful if the market turns lower depending on one's outlook and risk appetite.

The aforementioned approach is known as hedging, and it is readily available to crypto market participants much like it is to investors and traders in the more traditional markets like stocks.

Cryptocurrency Futures: How to Hedge Investment

Hedging is a method of reducing risk in the portfolio and can be conducted at the position level, the portfolio level, or both. The intent of a hedge is to reduce the risk in a single investment or a group of other positions.

For example, a traditional buy-and-hold investor in the stock market might sell equity index futures to help protect their stock portfolio when fear creeps into the market. And that same mentality and approach can be utilized in the cryptocurrency market—especially because of recent additions in the crypto marketplace.

The first crypto futures arrived back in 2017, and one of the most important aspects of hedging is that an investor selects the appropriate product to use as a hedge.

For example, if a traditional buy-and-hold investor in the stock market wants to protect their portfolio during volatile times, then it’s critical to choose a product that's highly correlated with the stock market—such as a stock market index future (S&P 500, Nasdaq, Russell 2000).

That way, if the stock market drops and one’s portfolio loses value, then at least the hedge can produce a profit.

The same goes for a "hodler" in the cryptocurrency universe who wants to protect their portfolio during a downturn. And to deploy that position, one needs to utilize a cryptocurrency futures product that’s positively correlated to their investment.

Imagine a hypothetical crypto investor is holding a basket of digital coins like bitcoin and ether. While this hypothetical investor is likely in it for the long haul, they might be looking for added flexibility beyond holding the simple positions into the foreseeable future.

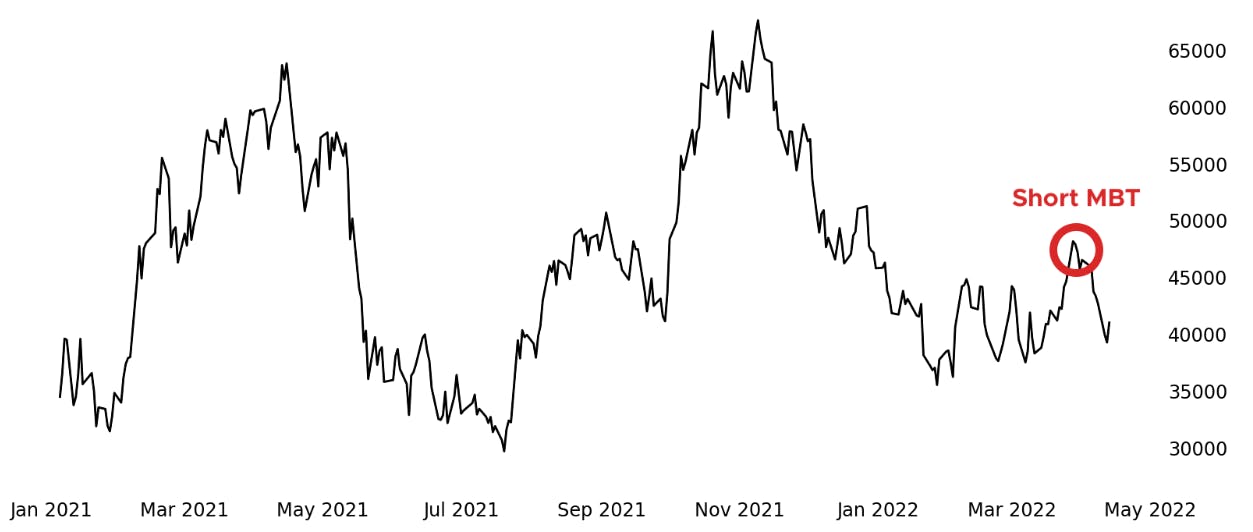

MBT \ Micro Bitcoin Futures

Source: Yahoo! Finance

Along those lines, a crypto “hodler” might choose to trade crypto-related options or crypto-related futures against their long-term investment. These derivatives allow crypto market participants to express a more diverse range of opinions that can profit in the short term while their investment plays out in the long term.

As referenced previously, a longtime crypto holder might decide to deploy a short crypto futures position to protect against their core holdings during a downturn. For example, an investment of 1 BTC can be hedged 10% at a time using short Micro Bitcoin futures that are 0.1 BTC and require less than 0.05 BTC in capital to trade.

Or, if a crypto investor thinks the market will trade in a range-bound fashion (i.e. sideways), they might decide to sell call options on crypto-related markets, to take advantage of mean reversion via short volatility much like in the equity options universe.

Cryptocurrency Futures: How to Speculate

Speculating is an active trading strategy that consists of long or short positions given bullish or bearish sentiments behind a market. Traders intend to make smaller profits in shorter time frames when speculating relative to investing, and they often use futures to magnify their potential returns with lower capital requirements.

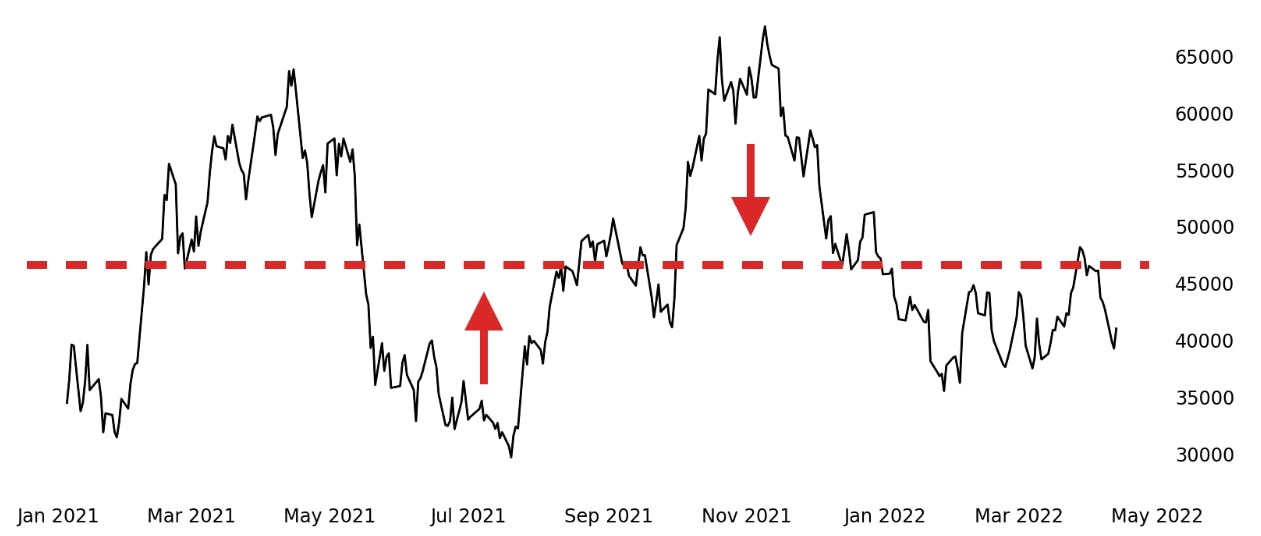

The reason behind a speculative trade can range from technical analysis to mean reversion to a simple opinion of a market coming from current events. For example, traders could make the case for Bitcoin being a mean-reverting asset - a market whose price tends to move around a long-term average value - and look to sell the market when it moves higher than its mean or buy the market when it moves lower than its mean.

MBT \ Micro Bitcoin Futures

Source: Yahoo! Finance

Other speculative strategies incorporate moving averages, fundamental research, and more, but the core consists of buying or selling for the short term.

Futures can make it easier to sell cryptocurrency given that most cash markets don’t allow for short selling and most futures markets are just as easy to sell as they are to buy. Also, futures are not inhibited by pattern day trading rules as stock are and this can make opening and closing a position in the same day no problem no matter the account size. Finally, lower capital requirements to trade Micro Bitcoin futures as opposed to the underlying market itself can amplify returns for smaller price movements.

Small Cryptocurrency Futures

Crypto market participants looking to hedge or speculate may want to learn more about more crypto-focused futures and derivatives products outside the vanilla Bitcoin and Micro Bitcoin futures.

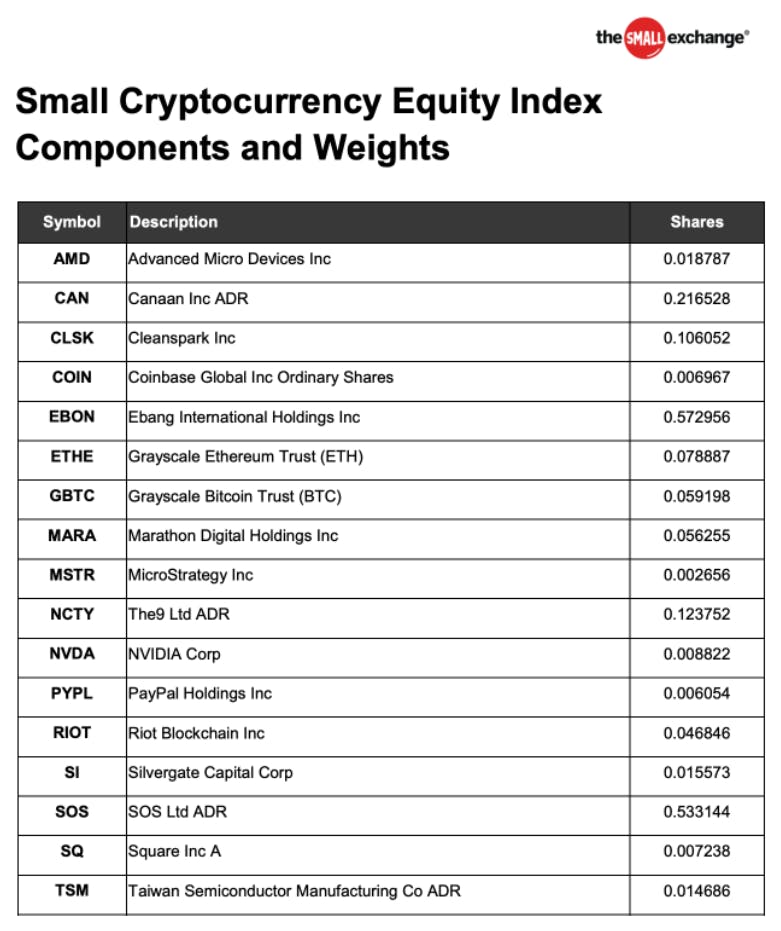

As an example, the Small Exchange offers the Small Cryptocurrency Futures (SCCX) - a futures product that closely tracks performance in the overall cryptocurrency sector, and using it is extremely straightforward.

A market participant that wants to get long cryptocurrency exposure can simply buy an SCCX future, while those looking to short cryptocurrency can simply sell SCCX. The latter position - a short Small Crypto futures position - is one that might theoretically be utilized by a “hodler” who wants to hedge a concentrated long crypto portfolio.

The Small Cryptocurrency Index, which the SCCX futures track, is made up of not only Bitcoin and Ethereum price exposure but also significant crypto stocks like Coinbase (COIN) Advanced Micro Devices (AMD). And those looking to speculate on the future of the cryptocurrency space can use SCCX as a more diversified and lower-cost alternative to even the Micro Bitcoin futures.

Products offered by the Small Exchange are specifically tailored for retail market participants because the overall level of exposure represented by the Smalls is considerably less than that of traditional futures contracts.

For example, not every trader wants to risk exposure to 1,000 barrels of crude oil or 5,000 bushels of corn. Instead, most retail traders want futures exposure that’s scaled toward the rest of their holdings.

To learn more about the Smalls, readers are encouraged to review this short installment of Small StakesSmall Stakes.

To learn more about cryptocurrency futures at the Small Exchange, visit the Small Cryptocurrency futures product page. For a guide on hedging with futures, check out this episode of The Leap: From Options to Futures all about hedging with futures.

Sign up for more articles like this with our free weekly market commentary.