How Interest Rates Can Affect Mortgage Rates

May 13, 2022

By Sage Anderson

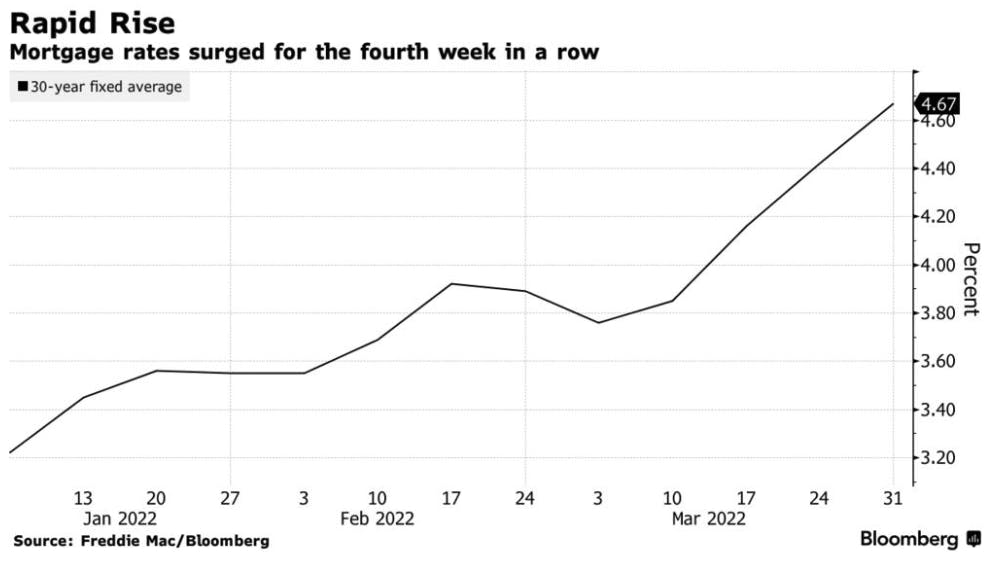

Don't look now but mortgage rates just popped above 5% for the first time since 2018, and the recent spike is even more impressive considering that mortgage rates started the year as low as 2.8%*.

That's bad news for potential home buyers, as the difference between a 3.5% mortgage and a 5.0% mortgage could easily be in the hundreds of dollars per month (depending on the total amount borrowed).

Rising mortgage rates could finally cool down the red-hot U.S. housing market, as the combination of higher home prices and higher mortgage rates hasn't traditionally been an optimal combination.

How the Fed Affects Interest Rates

The biggest reason that mortgage rates have increased so much this year ties back to the U.S. Federal Reserve. The Fed dropped benchmark interest rates - Federal Funds Rate (FFR) - to 0% during the onset of the COVID-19 pandemic to help stimulate the economy. That was nearly two years ago.

In 2022, the Fed has announced plans to raise benchmark interest rates back up toward "normal" levels. To that end, the Fed announced a 0.50% increase in the Fed Funds Rate at their May meeting. And the Fed has indicated there could be several more rate hikes to follow before the end of 2022.

How Interest Rates Affect Mortgages

This hiking of interest rates by the Fed, and simultaneous tightening of the economy, obviously affects prevailing rates in the market, too. For example, when benchmark rates increase, so do credit card rates, car loan rates, and home mortgage rates. The big move observed in mortgage rates since the start of the year provides a clear illustration of that reality. When the Fed suggested there will be additional raises to their benchmark interest rate several times in the near future, the US Treasury rates across the yield curve rose, and mortgage rates are largely modeled off of these, coinciding with the duration of the loan.

How to Hedge Against Rising Mortgage Rates

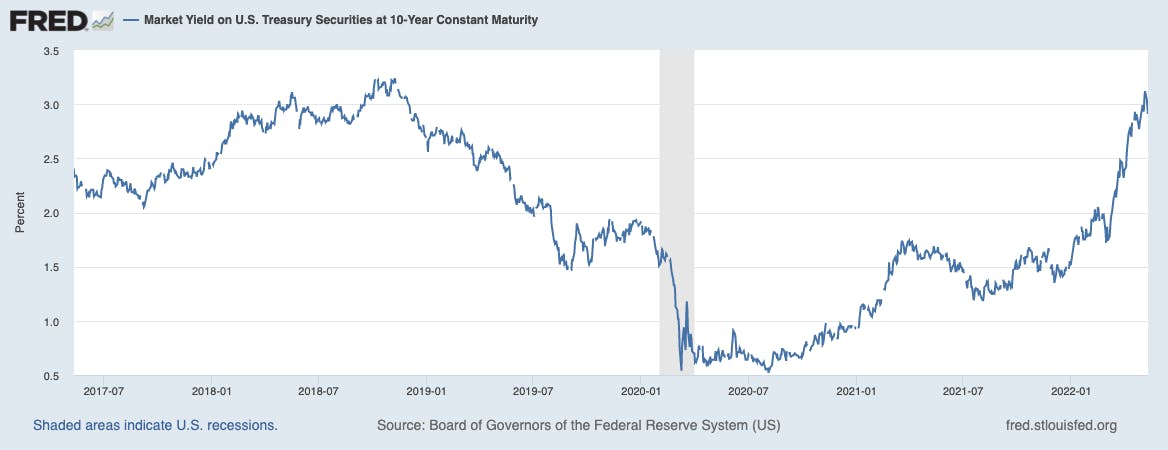

One of the most efficient ways to hedge against rising mortgage rates is by following the 10-year US Treasury yield. This product is one of the most-followed barometers of prevailing interest rates in the entire world.

Yield, in this context, refers to the amount of interest the US government pays on its debt. And Treasury yields are highly correlated to the benchmark interest rates controlled by the Fed.

For example, when the Federal Reserve dropped benchmark rates to zero in spring of 2020, the yield on the 10-year Treasury dropped to a record low of 0.54%. But as the U.S. economy has recovered from the effects of the pandemic, the yield on the 10-year Treasury has steadily increased.

At the start of 2022, the yield on the 10-year Treasury was trading about 1.5%. However, that number shot considerably higher in the wake of the Fed's recent decision to hike rates. As of early April, the 10-year Treasury yield was trading north of 2.75%.

Considering that mortgage rates followed a similar trend this year, one can see that the two are highly correlated.

The Fed met again at the beginning of May, and raised benchmark rates by another 0.50%. This hike has pushed 10-year Treasury yields higher as well.

However, market participants should keep in mind that potential hiccups in the underlying economy could easily disrupt the Fed’s plans. If the COVID-19 recovery slows down—or even worse, a recession materializes—then the Fed would likely be forced to reevaluate its current approach.

For example, if the monthly nonfarm payrolls report indicated a big drop in jobs, then the 10-year Treasury yield could likely move lower. The term "nonfarm payrolls" refers to the total number of workers in the United States—excluding farm workers and workers from a handful of other job classifications.

As one can see, yields are a great barometer for investors and traders to follow because they usually reflect any big changes to perceptions in the interest rates market.

To trade yields, investors and traders can use products such as the Small 10-Year U.S. Treasury Yield (S10Y) futures offered by the Small Exchange®.

For more background on trading interest rates using Treasury Yield futures offered by the Small Exchange, readers are encouraged to review the following episodes of Small Stakes:

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*https://fred.stlouisfed.org/series/MORTGAGE30US

© 2022 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, not intended as a recommendation, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. The information presented here is for illustrative purposes only, and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Trading futures and options on futures involves the risk of loss, including the possibility of loss greater than your initial investment.