Are Stock Options Too Expensive?

May 31, 2022

By Frank Kaberna

The first time you hear about the novelty and cost-effectiveness of stock options can be eye-opening. You can get long, short, or neutral from different prices in different time frames AND it can cost a fraction of the price for trading the stock itself.

How Does Stock Option Buying Power Requirement Work?

Almost all option margin systems set buying power requirements (BPR) partly as a function of risk in the trade. Thus, long options simply require as much buying power as it takes to buy the option; for example, an out-the-money call option on 100 shares of stock priced at 1.00 would often just cost $100 in BPR.

Short options, however, require some nuance given that they can carry large (sometimes theoretically infinite) amounts of risk if the underlying market witnesses an extremely large move. That said, the actual chance of a market rallying to infinity or falling to zero is essentially nil, so short calls and puts cost somewhere between $0 and the total amount of the underlying position (100 shares times the stock price).

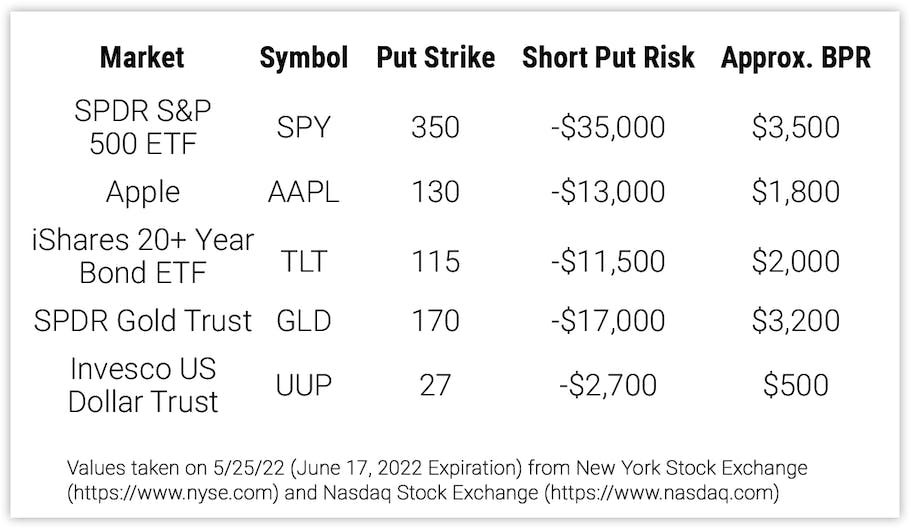

Back-of-the-envelope math shows that short options on both the call and put side of a stock cost between 10% and 20% for most markets. This value can fluctuate with time to expiration and strike price distance from stock price, but this casual rule can work for most of the single stock and ETF option markets. More cost-effective options allow you to construct strategies like the synthetic long stock position - selling the at-the-money put while buying the at-the-money call for 100 long deltas equivalent to 100 long shares - granting you similar exposure as the outright stock market for a fraction of the cost to trade stock (for example, 100 shares of SPY currently costs about $20,000 in BPR whereas the short put-long call combo costs about $9,000).*

Is this relatively-more-efficient-than-stocks way to trade the most efficient use of your capital per unit of exposure? That is, do stock options give you the biggest bang for your buck or just a bigger bang?

How Does Futures Option Buying Power Requirement Work?

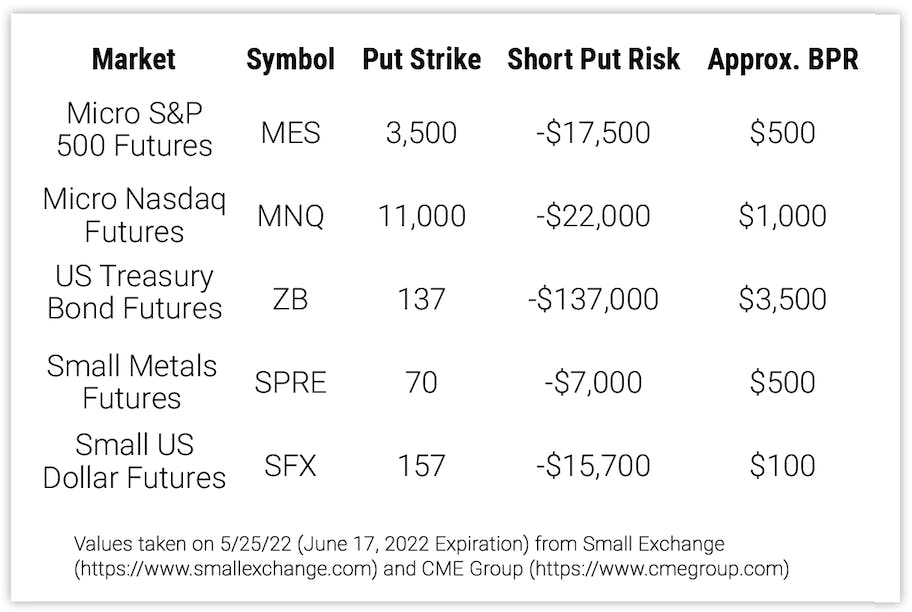

Futures themselves can be much less costly than stocks per unit of exposure given their more dynamic margin system that adjusts with volatility and size of the underlying market. For example, US dollar futures like the Small US Dollar (SFX) futures can cost as little as 1-2% of the underlying market’s size since forex markets are historically some of the least volatile; USD ETFs like UUP still require BPR at a 50-100% rate the same as other more volatile products.

The same efficient margin system is used for options on futures, which means that futures options are priced relative to perceived risk in the position unlike stock options that are priced more or less based on the product’s size. This more dynamic margin can allow for large reductions in BPR for trading futures options versus stock options on the same market. For example, GLD options carry a little more than twice the exposure as SPRE options, but they cost over six times as much.

You’ll notice that the risks of trading futures options are now similar and in some cases lesser than those associated with stock options, and the costs to trade the former are a fraction of the latter. So while jumping from stocks to stock options can be truly eye-opening, just wait until you see futures options.

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

*Values taken on 5/25/22 (June 17, 2022 Expiration) from New York Stock Exchange (https://www.nyse.com)